Rollover Your 401k to an IRA in Mesa with Financial Advisor Pro.

Get A Free 401k Rollover Consultation

When You Have An Old 401k Here Are Your Options

When you leave a job where you had a 401k plan, you typically have 4 options:

- Take a cash distribution out of your 401k (caution: taxes will be due and a potential 10% IRS penalty).

- Keep the 401k in your previous employer's 401k plan (if allowed).

- Transfer your old 401k to your current employer's 401k plan (if it's available and if transfers are allowed).

- Transfer your old 401k into an Individual Retirement Account (IRA) with an investment firm.

However, depending on how you rollover your 401k can effect your specific tax situation or the growth potential of your wealth. All of which we cover below.

How Does A 401k Rollover Work?

Sometimes a former employer allows a direct rollover, where the money is transferred from your old 401k to your IRA company without you ever touching it. Otherwise a regular Rollover is permitted, where you receive the funds, usually in the form of a check from your previous employer, for the balance of your old 401k. Then you must forward that check to your IRA company within 60 days. It's crucial to follow the 60 day rule carefully because failure to meet this deadline could result in the distribution being treated as taxable income, subject to your regular income tax rates, and if you're under 59½, you may also face an additional 10% early withdrawal penalty. Now let’s cover rollover 401k to ira tax consequences depending on what type of account you have.

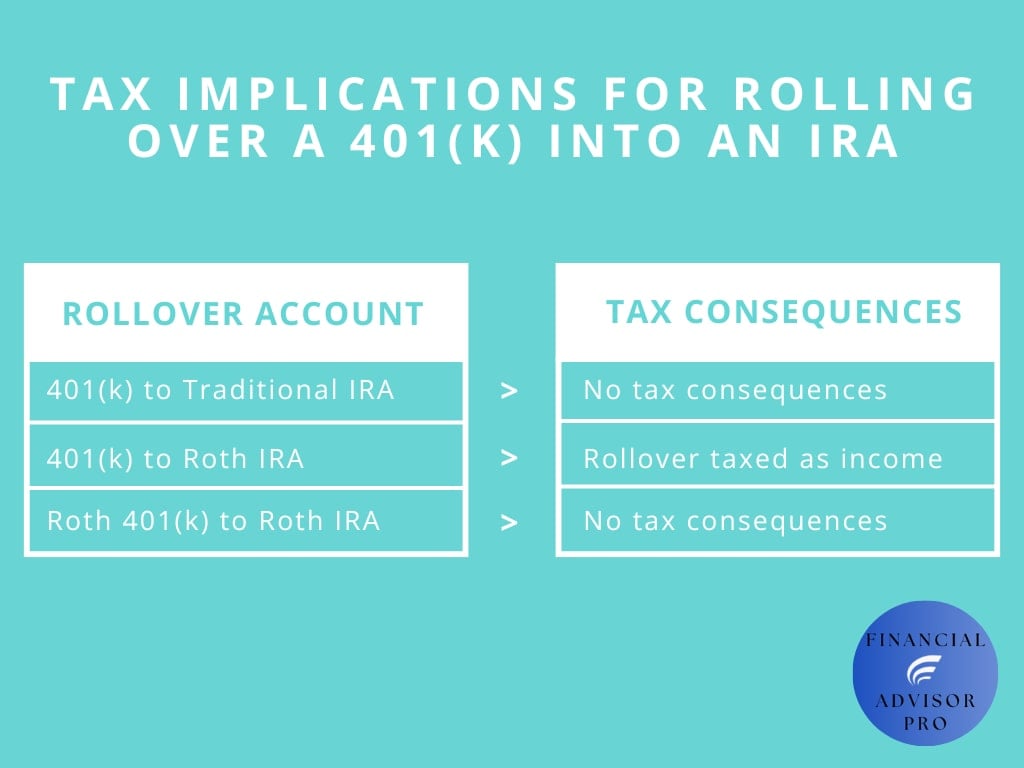

Tax Implications of Rolling Over 401k to IRA

Simple rule of thumb: Keep your IRA the same as your 401k, and there are no tax consequences. If you have a regular 401k and you're rolling over funds into an IRA, opt for a traditional IRA. If you have a Roth 401k (indicated as "Roth" on your old 401k statements), open a Roth IRA for the rollover to avoid tax consequences. Just remember to fund whichever IRA you create (Traditional or Roth) within 60 days of executing your 401k rollover to avoid IRS penalties.

However, for those who choose to rollover a regular 401k to a Roth IRA, it's important to note that your rollover amount is taxed as ordinary income. If you choose this route, the best thing to do is rollover the 401k into a traditional IRA, then convert it to a Backdoor Roth IRA, which allows you to convert a portion (or all) of your traditional IRA into a Roth IRA. This way, you can plan the correct amount to convert without putting yourself into a new tax bracket. Plus, this also avoids the scenario where, if you're under 59½, you would have to pay an additional 10% early withdrawal penalty.

Additionally, even if you're already in retirement and currently taking money out of your 401k, you can still do a rollover into an IRA if you choose.

Benefits Of Rolling Your 401k Into An IRA

Rolling over your 401k into an IRA can offer several benefits. Firstly, working with a licensed financial advisor makes the process much easier, as you have a guide who knows how to navigate the paperwork, process, and proper investments to put your money in (check out our top Asset Management 401k rollover companies below). Secondly, it provides greater control and flexibility over your retirement savings, allowing you to choose from a wider range of investment options tailored to your financial goals and risk tolerance. Additionally, consolidating multiple retirement accounts into a single IRA can simplify your retirement planning and make it easier to manage. Furthermore, IRAs often have lower fees compared to 401k plans, potentially reducing the overall cost of investing. Lastly, over time, your old 401k company will roll over your 401k into a money market. A money market is a very low interest earning type of fund, thus limiting your growth potential over time. Overall, a 401k rollover into an IRA can empower you to take charge of your retirement planning and optimize your financial future.

What Is A Mutual Fund, IRA, And What Is Their Relationship?

Delving into the world of investments involves understanding key components like a mutual fund, IRA, and the importance of seeking guidance from a licensed/certified financial advisor. Let's break down these concepts in simple terms.

Mutual Funds: A mutual fund is a pool of money collected from multiple investors (people in the public) to invest in a diversified portfolio of stocks, bonds, or other investments. It's a smart choice for those seeking advice from a professional asset management company without the need for individual stock picking.

IRAs (Individual Retirement Accounts): When it comes to planning for retirement, play a crucial role. There are two main types: Roth IRAs and Traditional IRAs.

Roth IRA vs Traditional IRA: Roth IRAs and Traditional IRAs have distinct features. In a Roth IRA, contributions are made with after-tax dollars, and qualified withdrawals in retirement are tax-free. On the other hand, Traditional IRAs allow you to make pre-tax contributions, potentially lowering your taxable income today, with withdrawals taxed in retirement.

Certified Financial Advisor:

Navigating the complexities of Roth IRA vs Traditional IRA and maximizing your retirement savings often requires the expertise of a certified financial advisor. These professionals, sometimes referred to as a licensed financial advisor or fiduciary, can provide tailored advice based on your financial goals and risk tolerance.

Why Choose Us For A 401k Rollover - Financial Advisor Pro

When individuals attempt to manage their own investments, they expose themselves to inherent risks and potential financial pitfalls.

According to a study by DALBAR, the average investor managing their own money tends to significantly underperform the market, with the 20-year average annual return for equity mutual fund investors being only 5.19%, compared to the S&P 500 index's average annual return of 7.47% during the same period.

Similarly, investors who utilized a financial advisor benefited from an average annual return that was approximately 3% higher compared to those who managed their investments independently. These statistics highlight the dangers of self-directed investing and underscore the importance of working with an asset management company.

By leveraging our expertise, proven investment strategies, mutual funds, and meticulous risk management techniques, individuals can enhance their investment performance and navigate the financial landscape with confidence, ultimately achieving their financial goals.

Mutual Fund Companies We Represent

Determining the best asset management company requires careful consideration of individual needs and circumstances. We understand that everyone's situation is unique, and that's why Financial Advisor Pro represents many different asset management companies when assisting with rolling over a 401k into an IRA.

Whether it's Invesco, Fidelity, Franklin Templeton, or one of our other top tier asset management companies, each partner brings a distinct set of strengths and expertise. This allows clients to find the ideal match for their investment goals, risk tolerance, and financial preferences.

Get A Free 401k Rollover Consultation

Rollover 401k To IRA Client Testimonials

Larraine B.

Mesa, AZ

Financial Advisor Pro made my Rollover 401k to IRA process incredibly smooth. Plus they got me in a much better investment program. Thanks to them, my wealth has grown significantly.

Rebecca & Chris R.

Mesa, AZ

Working with Financial Advisor Pro has been a game-changer. They took the time to teach us the foreign language of investments and now we're ahead of schedule to reach our financial goals. Their guidance has been amazing.

Sherrie G.

Phoenix, AZ

I'm super grateful to Financial Advisor Pro for their non-judgement educational approach to my financial ignorance. They made rolling over my 401k to an IRA a super simple process.

Dale M.

Tempe, AZ

For me, trusting others with my retirement was very difficult. I always managed my own money but over time Financial Advisor Pro has been incredible in guiding me. Eventually, I saw the value working with them and they helped me roll over my 401k to an IRA. They've become more than just advisors—they're friends I can always call for help and advice.

Jason & Brit.

Mesa, AZ

Our experience with Financial Advisor Pro for our 401k rollover to an IRA was fantastic. They took the time to explain everything and made sure we understood everything on a simple level. Thanks to them, we're building a strong financial future for our family.

Irishia W.

Mesa, AZ

These guys made the rollover process super easy and stress-free. Their expertise helped double my retirement savings, allowing me to retire early instead of working indefinitely.

Danielle & Mike W.

Mesa, AZ

We felt somewhat knowledgeable about investing, but when we decided to invest with Financial Advisor Pro, we quickly saw the benefit of working with a professional advisor. We've learned more about wealth and how to be smart with our money because of Financial Advisor Pro.

Erika S.

Gilbert, AZ

These guys are like money ninjas. I had three different 401ks, and they tracked them all down and made what I thought was going to be super complicated really simple. Plus, my account has grown a lot since I rolled over my 401k to an IRA.

Carl G.

Mesa, AZ

My family was never big on finances growing up. But after one consultation and learning from their website, I learned more about money than I ever did in my whole life. These guys have helped me a lot in ways I never thought possible.

Mesa, AZ Popular Services: