Maximize Your Retirement Savings with a Tax-free 401k Rollover to IRA

Thank you for subscribing!

Have a great day!

Why Should You Rollover a 401k to an IRA?

Rolling over a 401k into an IRA opens the door to more investment opportunities and helps you maximize your retirement savings. Whether you're retiring, changing jobs, or simply want more control over your investments, an IRA rollover can offer you more flexibility and better options.

How Does a 401k Rollover to an IRA Work?

A 401k rollover involves transferring your retirement funds from a 401k to an IRA. With a direct rollover, you avoid taxes and penalties. Here’s a simple breakdown of the steps:

- Choose your IRA provider.

- Request a direct rollover from your 401k provider.

- Transfer your funds without the check coming to you in your name.

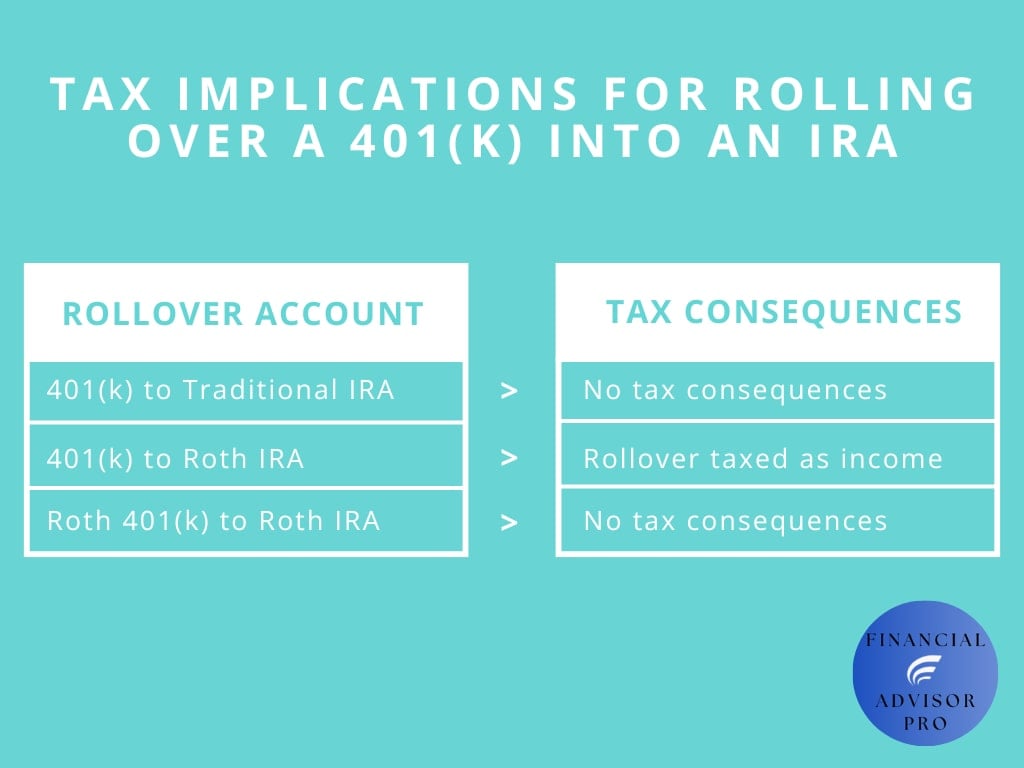

Tax Implications of Rolling Over a 401k to an IRA

Taxes are important because rolling over a 401k into a traditional IRA won't result in any taxes, while moving it into a Roth IRA means the amount will be taxed as income. Additionally, rolling over a Roth 401k into a Roth IRA is tax-free, making it a simple and straightforward option. When rollovers are completed with a "direct rollover", it allows you to move your funds tax-free from your 401k, and the funds go directly to your IRA company.

Should You Consider a Roth IRA Conversion?

A traditional 401k can be rolled over to either a traditional IRA or a Roth IRA. Rolling into a Roth IRA may require you to pay taxes upfront, but it allows for tax-free withdrawals in retirement. If you’re unsure whether a Roth IRA conversion is the right move, we’re here to help you weigh the pros and cons.

Advantages of Rolling Over a 401k to an IRA

Why choose an IRA over a 401k? Here are some advantages:

Broader Investment Choices: An IRA provides access to more investment options, including stocks, bonds, and mutual funds.

Lower Fees: IRAs often have lower fees compared to 401k plans.

More Flexibility: You control how and where your money is invested, giving you greater flexibility in managing your retirement savings.

What Is The Relationship Between IRAs & Mutual Funds?

Mutual funds are a popular investment option for IRA holders because they offer diversification and professional management. Learn more about how mutual funds fit into an IRA with the video below:

Common Mistakes to Avoid When Rolling Over a 401k

Handling Funds Directly: Avoid the risk of taxes and penalties by opting for a direct rollover.

Missing the 60-Day Deadline: If you receive a check, deposit it into an IRA within 60 days to avoid penalties.

Not Considering Future Taxes: If converting to a Roth IRA, be sure to plan for any taxes that may be due.

Choosing the right IRA for your rollover:

Should you go with a traditional IRA or a Roth IRA? Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free growth. Let us help you decide which option is best for your financial goals.

Why Choose Us For A 401k Rollover - Financial Advisor Pro

At Financial Advisor Pro, we bring over a decade of experience helping individuals successfully navigate the complexities of rolling over their 401k into an IRA. Our team of licensed agents has guided more than 3,000 clients through tax-free 401k rollovers, ensuring their hard-earned retirement savings are transferred securely and efficiently, without penalties or hidden fees.

We understand that every financial situation is unique, which is why we take a personalized approach to your rollover, offering tailored investment options that align with your goals and risk tolerance. Our commitment to transparency, expert knowledge, and long-term financial growth makes us the trusted choice for optimizing your retirement funds. Let us handle the details, so you can focus on building a brighter financial future.

Trusted Mutual Fund Companies We Work With to Optimize Your 401k Rollover

When rolling over your 401k into an IRA, choosing the right mutual fund company is crucial for maximizing your investment potential. At Financial Advisor Pro, we work with some of the most trusted names in the industry, including Fidelity, Invesco, and Franklin Templeton, to ensure that your hard-earned savings are managed with expertise and care. Our partnerships with these top-tier companies allow us to provide a wide range of investment options tailored to your specific financial goals, risk tolerance, and long-term plans. With these trusted mutual fund companies, you can feel confident that your 401k rollover is in capable hands, giving you the flexibility and security to grow your wealth for the future.

401k Rollover Client Testimonials

Larraine B.

Financial Advisor Pro made my Rollover 401k to IRA process incredibly smooth. Plus they got me in a much better investment program. Thanks to them, my wealth has grown significantly.

Rebecca & Chris R.

Working with Financial Advisor Pro has been a game-changer. They took the time to teach us the foreign language of investments and now we're ahead of schedule to reach our financial goals. Their guidance has been amazing.

Sherrie G.

I'm super grateful to Financial Advisor Pro for their non-judgement educational approach to my financial ignorance. They made rolling over my 401k to an IRA a super simple process.

Dale M.

For me, trusting others with my retirement was very difficult. I always managed my own money but over time Financial Advisor Pro has been incredible in guiding me. Eventually, I saw the value working with them and they helped me roll over my 401k to an IRA. They've become more than just advisors—they're friends I can always call for help and advice.

Jason & Brit T.

Our experience with Financial Advisor Pro for our 401k rollover to an IRA was fantastic. They took the time to explain everything and made sure we understood everything on a simple level. Thanks to them, we're building a strong financial future for our family.

Irishia W.

These guys made the rollover process super easy and stress-free. Their expertise helped double my retirement savings, allowing me to retire early instead of working indefinitely.

Danielle & Mike W.

We felt somewhat knowledgeable about investing, but when we decided to invest with Financial Advisor Pro, we quickly saw the benefit of working with a professional advisor. We've learned more about wealth and how to be smart with our money because of Financial Advisor Pro.

Erika S.

These guys are like money ninjas. I had three different 401ks, and they tracked them all down and made what I thought was going to be super complicated really simple. Plus, my account has grown a lot since I rolled over my 401k to an IRA.

Carl G.

My family was never big on finances growing up. But after one consultation and learning from their website, I learned more about money than I ever did in my whole life. These guys have helped me a lot in ways I never thought possible.

Frequently Asked Questions About 401k Rollovers to IRAs

Can I roll my 401k into an IRA without penalty?

Yes, you can roll your 401k into an IRA without penalty if you choose a direct rollover. This process moves your funds directly from your 401k provider to your IRA provider, avoiding taxes and penalties. However, if you opt for an indirect rollover and receive the funds yourself, you must deposit them into an IRA within 60 days to avoid penalties or taxes.

What’s the difference between a direct and indirect rollover?

A direct rollover transfers funds directly from your 401k provider to your IRA provider, avoiding taxes and penalties. An indirect rollover involves receiving the funds first (with the rollover check written only in your name), and you must deposit them into an IRA within 60 days to avoid penalties.

Is it a good idea to rollover a 401k to IRA?

Yes, rolling over a 401k to an IRA can be a great idea for many individuals. It often provides more flexibility with investment options, lower fees, and better control over your retirement savings. An IRA can also offer greater diversification, allowing you to tailor your investments to your financial goals and risk tolerance. Additionally, a direct 401k to IRA rollover is typically tax-free, helping you avoid penalties while keeping your retirement funds growing for the future.

Will I be taxed if I rollover my 401k to an IRA?

When you roll over your 401k to a traditional IRA, you won't be taxed since both accounts are funded with pre-tax dollars. However, if you roll over your 401k into a Roth IRA, the amount rolled over could be taxed as income because Roth IRAs are funded with post-tax dollars. The specific tax implications depend on the type of IRA you choose and what type of 401k you have.

How much can I roll over from a 401k to an IRA?

There is no limit to the amount you can roll over from a 401k to an IRA. You can transfer the entire balance of your 401k to an IRA in a direct rollover, ensuring your retirement savings continue to grow tax-deferred without penalties. Keep in mind that if you choose a Roth IRA, taxes may apply on the rollover amount, as Roth IRAs are funded with post-tax dollars.

Can I roll over my 401k while still working?

Yes, you may be able to roll over your 401k while still working, but it depends on your employer's plan rules. Some companies allow what's called an "in-service withdrawal" if you are at least 59½ years old, enabling you to transfer a portion of your 401k to an IRA without penalties. It's important to check with your employer to see if this option is available to you.

Get a Free 401k Rollover Consultation

Thank you for subscribing!

Have a great day!