Avoid the Billion-Dollar Mistake When Rolling Over Your 401k to an IRA

By William Moon

Updated October 12, 2024

When rolling over your 401k into an IRA, it’s easy to make what some call a “billion-dollar mistake.” Trust me, it’s more common than you think. Many people unknowingly let their hard-earned retirement savings sit in cash, believing it’s the safe route. But in reality, this choice could cost you a lot over time.

The Billion-Dollar Blind Spot: Cash Drag

Here’s the deal: too many people leave a significant portion of their IRA in cash after a 401k rollover. Sure, it might feel like a safe bet, especially when markets are shaky, but this “billion-dollar blind spot” can seriously drag down your financial future. This phenomenon is often referred to as “cash drag,” and it’s exactly what it sounds like — cash sitting there doing next to nothing for you.

The Dangers of Holding Too Much Cash in Your IRA

Think about it: If your cash is earning a tiny return of 0.5% to 1%, but inflation is rising by 3%, your savings are actually shrinking in value year after year. This might not sound like a big deal over a short period, but remember, IRAs are designed for long-term growth. Over the decades, this lost potential can add up to a substantial amount of missed money.

Vanguard’s research reveals that many people don’t even realize their IRA is sitting in cash. In fact, two-thirds of investors surveyed said they had no idea how their IRA assets were allocated after a rollover. Ouch! Whether it’s due to uncertainty, procrastination, or playing it safe, leaving too much in cash can derail your retirement goals.

Why 401k Rollovers to IRAs Often Result in Cash Drag

A big reason for this oversight is the difference between how 401k plans and IRAs work. In a 401k, your investments might be automatically managed for you, often through something like target-date funds. However, in an IRA, your funds usually land in cash until you take action.

And that’s where many people drop the ball.

They see the cash sitting there and think it’s a solid, low-risk option. But, the truth is, your retirement savings should be working hard for you, not sitting idle. Inflation alone is enough to erode the real value of your money over time, and with minimal returns on cash, it’s a losing game.

How to Avoid This Billion-Dollar Mistake

The good news? You don’t have to fall into this trap. Here’s how to keep your rollover working for you, not against you:

Pick Your IRA Provider Wisely

The first step is choosing the right IRA provider that offers a variety of investment options that fit your needs. Look for one that gives you control and flexibility.

Choose a Direct Rollover

Make sure to go with a direct rollover, where your funds move directly from your 401k into your IRA without touching your hands. This avoids unnecessary taxes or penalties.

Invest Sooner, Not Later

Once your money lands in the IRA, don’t let it sit in cash. Reinvest it as soon as possible. If you’re unsure about which investments to choose, consider a target-date fund or speak with a financial advisor to create a diversified plan that matches your retirement goals.

Diversify Your Portfolio

Spread your investments across a mix of stocks, bonds, and other assets that suit your risk tolerance and retirement timeline. This helps minimize risk while maximizing growth potential.

Check Your Cash Balance Regularly

Even after your initial investment, it’s important to check in on your IRA from time to time. Keep an eye on how much cash you’re holding. A small portion of cash is fine for short-term needs, but the majority of your savings should be in growth-oriented investments.

How to Stay Engaged and Avoid Cash Drag in Your IRA

Rolling over your 401k is just the first step. To avoid the billion-dollar mistake of cash drag, you need to stay engaged with your investments. Check in on your IRA regularly and make adjustments as needed. Over time, markets shift, and your investment strategy should evolve along with them. Rebalancing your portfolio is key to ensuring your money keeps working for you, not against you.

Why Rebalancing Your IRA is Critical

By rebalancing — shifting assets between cash, stocks, and bonds — you ensure that you’re maximizing your IRA’s growth potential, especially when market conditions change. This simple, ongoing maintenance can help you avoid letting too much cash sit idly, ensuring your retirement savings grow as much as possible over the years.

What Are the Tax Implications of a 401k Rollover?

When rolling over a 401k to an IRA, the tax implications largely depend on how the rollover is executed. There are two main types of rollovers: direct and indirect.

Direct Rollover:

This is the most tax-efficient option. In a direct rollover, your 401k funds are transferred directly from your 401k plan to your IRA without you ever handling the money. Since the funds never pass through your hands, there are no taxes or penalties involved in the process. This method also helps you avoid mandatory withholding taxes.

Indirect Rollover:

With an indirect rollover, the 401k funds are given to you first, and you have 60 days to deposit them into an IRA. However, there’s a catch: your 401k provider is required to withhold 20% of the distribution for taxes. You’ll need to make up that 20% out of pocket when depositing the full amount into your IRA to avoid taxes and penalties. If you miss the 60-day deadline, the IRS considers the distribution a withdrawal, and it will be subject to income tax, as well as an additional 10% early withdrawal penalty if you’re under 59½.

In either case, it's essential to understand the tax implications upfront and opt for a direct rollover whenever possible to avoid any unnecessary tax consequences or penalties.

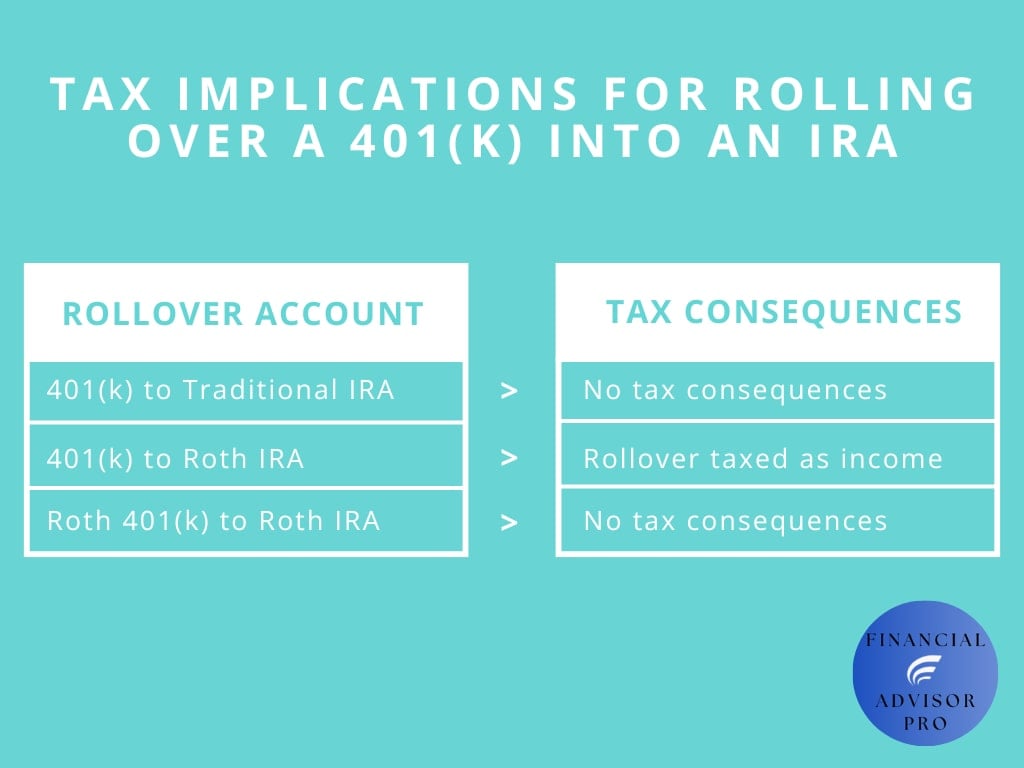

Use The Right Account for Your Rollover

When rolling over your 401(k) into an IRA, it's important to understand the tax implications. If you're rolling over a 401(k) to a Traditional IRA or a Roth 401(k) to a Roth IRA, there are no immediate tax consequences, making these rollovers tax-free. However, rolling over a 401(k) into a Roth IRA will be taxed as income for that year, potentially increasing your tax liability.

Final Thoughts

The billion-dollar mistake of leaving too much cash in your IRA after a 401k rollover is avoidable. The key is to stay proactive, invest wisely, and keep your funds working for you. Don’t let your retirement savings fall victim to cash drag. Instead, take control, reinvest strategically, and review your portfolio regularly to keep your retirement on track.

Still unsure about your 401k rollover? Don’t wait—speak with a licensed financial advisor today to create a personalized investment strategy and start growing your retirement savings right away!

Disclaimer

The information provided by Financial Advisor Pro is for educational purposes only and should not be considered as tax, legal, or financial advice. It is not intended to be relied upon as a forecast, research, or investment advice, nor is it a recommendation, offer, or solicitation to buy or sell any financial products or services, or to adopt any investment strategy. Decisions regarding taxes, investments, and any other financial matters should be made with the guidance of a qualified professional. We make no representations or warranties, express or implied, regarding the accuracy, completeness, or timeliness of the information provided, nor the results obtained from its use.