Life Insurance Agent in Mesa, AZ

Claim Your Free Life Insurance Quote Now

Life insurance as a solution provides you with a vital safety net, ensuring that your family can maintain their standard of living and cover essential expenses even after your loss. Policies are designed to replace lost income, and alleviating the financial strain on your dependents. Moreover, the tax-free nature of life insurance payouts offers you peace of mind, knowing that your loved ones will be protected from financial burdens during an emotionally challenging time.

Why Use Us For Your Life Insurance Needs?

Working with Financial Advisor Pro as your life insurance agent means benefiting from their expertise and deep understanding of the Mesa & the surrounding areas. As local experts, they add a personal touch to life insurance, ensuring that your coverage is tailored to the unique needs of your area. Having a local agent is crucial for personalized, accessible service and peace of mind.

There Are 2 Main Types of Life Insurance:

Why Term Life Insurance Is Better Than Any Other Type Of Insurance

Term Life Insurance

Term Life Insurance is a type of life insurance recommended by experts like Dave Ramsey and Suze Orman because it offers the highest coverage amount for the lowest cost. You pay a little bit of money every month for a specific amount of time (typically for terms of 10, 20, or 30 years), and if you pass away in that timeframe, your family gets a paycheck in the amount of money that you qualified for when you applied for the policy. And if you outlive the term, you could be investing in high quality mutual funds to become financial independent.

Permanent Life Insurance

Permanent life insurance, sometimes known as whole life insurance, universal life insurance, or index universal life insurance, is a long-term coverage plan that lasts throughout your lifetime. According to nerdwallet.com, permanent life insurance provides a death benefit and it contains a savings component in the policy, called cash value, that has the potential to grow over time. However, this is not what we recommend due to the high costs of these policies and the low performance of the savings component.

Life Insurance Through Work Doesn't Count

Work-provided life insurance offers you a small amount of coverage, but it often falls short in meeting the comprehensive needs of your family. According to a study by LIMRA, work-provided life insurance typically provides coverage equivalent to only one to three times your annual salary, which is insufficient for your family (considering your debt, income replacement, funeral expenses, and the rising cost of living). Additionally, coverage ends when you terminate employment or become disabled over 90 days and are taken off active payroll, leaving you without protection during crucial periods. Furthermore, the reliance on workplace coverage leaves you vulnerable, as you do not have control over the policy or the ability to customize it to your specific needs.

Life Insurance Services Offered

Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years, offering a straightforward and affordable option. You might choose this due to the low cost to cover significant expenses like a mortgage, debt, income replacement, or your children’s education costs.

Final Expense Life Insurance: Designed to cover end-of-life costs such as funerals and medical bills, providing peace of mind for you and your family. You might choose this option to ensure your loved ones aren't burdened with these expenses during a difficult time.

Primary Areas We Serve: East Phoenix Valley and surrounding areas.

- Upon request, we are willing to travel Phoenix valley wide to come to you or connect via Zoom Nationwide.

Local Expertise | Personalized Service | Affordable Rates | Licensed Professionals

Our Satisfied Customer Testimonials

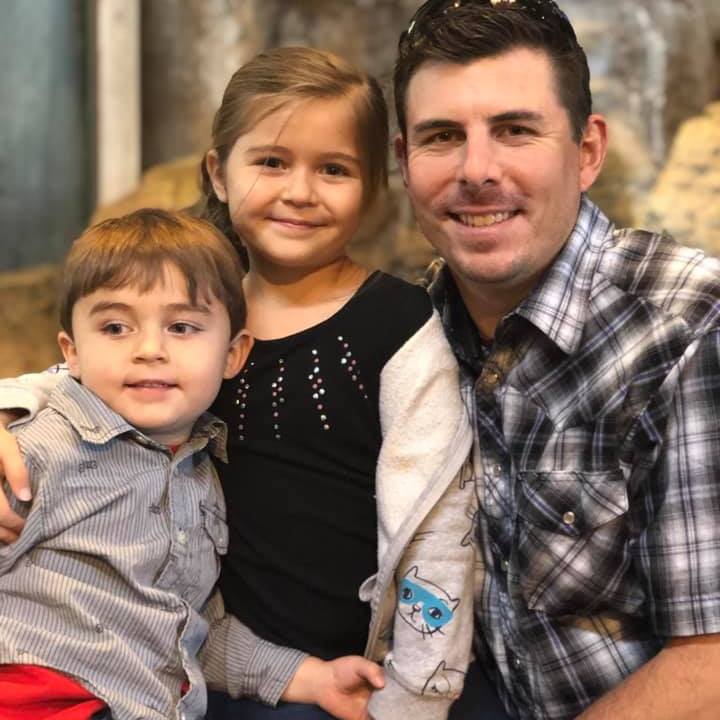

Grant & Alyssa C.

Tempe, AZ

Financial Advisor Pro's team has helped us so much. I've loved how much peace we have from knowing we're investing in smart ways. Plus, even if, heaven forbid, one of us passes away our kids still have a bright future.

Jeffrey M.

Mesa, AZ

Knowing my family is financially protected means everything to me. These life insurance agents made the process very simple & quick for getting the life insurance my family needed & it was within our budget.

Ryan E.

Mesa, AZ

Thanks to Financial Advisor Pro they made the process for getting life insurance super easy. Knowing we'd leave millions for my kids future makes me feel fulfilled as a parent.

Jen & Carlos P.

Mesa, AZ

We've been clients of Financial Advisor Pro for over a decade. They have been super patient in educating us on the best financial tools and the personal connection we have with our life insurance agent has made it super worth it to be a client.

Charles & Rachel K.

Mesa, AZ

These guys really taught us the value of being prepared financially. They personally took the time to help us understand the value of life insurance and helped us get a policy so we can leave behind generational wealth.

Nate & Casia F.

Gilbert, AZ

These agents are super cool and really good at what they do. They've made a million dollar difference for my family and can for yours too. I wouldn't do business with any other company because I know these guys actually care about what they do.

Brian & Linea G.

Mesa, AZ

Working with these guys for life insurance has been so illuminating. It has taken financial information we never thought was for us as middle class Americans and made it accessible, useful and profitable for our family.

Kate & Adam D.

Mesa, AZ

I wouldn't have been interested if it wasn't for the friendship and consistent persistence of Financial Advisor Pro's team. The financial peace is a bonus because I have learned more about finances here than anywhere else.

Travis & Wendy M.

Mesa, AZ

It's nice that our life insurance agent has become our friend and not just someone we talk finances with. Plus they explain things in a way that's super easy to understand and not high pressure sales talk.

Frequently Asked Questions

What is life insurance?

Life insurance is a policy that provides financial protection to your loved ones in the event of your death, ensuring they can cover essential expenses and maintain their standard of living. By purchasing life insurance, you can secure peace of mind knowing your family will be financially supported when they need it most.

How much life insurance do I need and for how long?

To determine how much life insurance you need, consider factors like your income, debts, living expenses, and future financial goals for your family. A good rule of thumb is to aim for a policy that is 6 to 12 times your annual income, but consulting with a local expert like Financial Advisor Pro can help tailor the coverage to your specific needs.

How much does it cost to work with a local life insurance agent?

Working with a local life insurance agent like us is completely free for you. The insurance companies we place business with compensate our agents, so you get personalized, expert advice without any additional costs.

How much does life insurance cost?

The cost of life insurance depends on factors like your age, health, policy type, and coverage amount. By working with a local life insurance agent, you can get personalized quotes to find a policy that fits your budget and needs.

What Type Of Policy Is Best For Your Family? - Your Options

When it comes to protecting your family's financial future, many various term lengths available, including 10, 15, 20, 25, 30, and 35 years, choosing the right policy for your family's unique needs is crucial. However, we will guide you through the process of selecting the most suitable term length.

Considerations When Choosing a How Much Coverage Your Need:

- Family Needs:

- Evaluate your family's current and future financial obligations, such as mortgages, education expenses, and other debts.

- Affordability:

- Consider your budget and choose a term length that aligns with your financial capabilities.

- Age and Health:

- Younger and healthier individuals generally qualify for lower premiums. Consider locking in a longer-term when you are in good health to secure affordable rates.

- Future Planning:

- Anticipate significant life events like the birth of additional children or the purchase of a home when selecting a term length.

Choosing the Best Term Insurance Length:

- 10-Year Term Life Insurance:

- Ideal for short-term financial obligations or if you expect your need for coverage to diminish over a short time frame.

- Well-suited for individuals in their 50s or older with short-term financial responsibilities such as mortgages or educational expenses for their children.

- 15-Year Term Life Insurance:

- Offers slightly longer coverage, making it suitable for families with a bit more extended financial planning.

- Great for providing protection for individuals in their late 40s or 50s or older during a child's early years or for covering a mortgage with a moderate repayment period.

- 20-Year Term Life Insurance:

- A popular choice for families with young children or those looking to cover a mortgage with a standard 15- to 30-year term.

- Provides a balance between affordability and long-term coverage for individuals of any age.

- 25-Year Term Life Insurance:

- Suited for families with longer-term financial commitments, such as planning for a child's education or paying off a more extended mortgage.

- This is a great option for those in their 40s or younger as it is affordable and provides coverage for along period of time.

- 30-Year Term Life Insurance:

- Offers extended protection for families with young children or long-term financial obligations.

- A reliable option for those in their early 40s or younger looking to secure their family's financial future until their children are financially independent.

- 35-Year Term Life Insurance:

- Ideal for young families with very long-term financial commitments, such as ensuring coverage until retirement or paying off an extended mortgage.

Our custom life insurance quotes provide a legacy and an everlasting future for your family. More than policies, we weave a tapestry of everlasting memories, ensuring your story lives on. It's not just life insurance for life; it's a melody of reassurance. Let our licensed life insurance agents guide you to a future where every heartbeat echoes with love and protection.

Can You Get Term Life Insurance With No Medical Exam?

The answer is a resounding yes! Let's explore the benefits of no-medical-exam term life insurance, as well as how those opting for a medical exam can enjoy additional advantages.

No Physical Term Life Insurance:

No physical exam term life insurance is designed for those seeking a convenient and streamlined application process. This option allows individuals to secure life insurance coverage without the need for a physical examination or extensive health inquiries. However, the application process still involves answering health-related questions, a check of previous medical records for the last 10 years, and less coverage may be issued. Thus making this an attractive choice for those who may have concerns about the medical exam or are looking for a quicker approval process.

Benefits of No-Medical-Exam Term Life Insurance:

- Speed and Convenience:

- The application process is faster and more convenient since there is no need to schedule and undergo a medical exam. This can be particularly advantageous for those who need coverage quickly.

- Accessibility:

- No-medical-exam policies are often more accessible for individuals with certain health conditions or those who may find it challenging to qualify for traditional life insurance.

- Privacy:

- Applicants may appreciate the privacy that comes with not having to disclose detailed medical information or undergo a physical examination.

Discounts for Medical Exam Applicants:

While no-medical-exam term life insurance offers convenience, those who are willing to undergo a medical examination may benefit from certain advantages, including discounts on their premiums. Here's why opting for a medical exam can be a financially savvy decision:

- Accurate Risk Assessment:

- A medical exam provides insurers with a more comprehensive understanding of your health, allowing them to assess risk more accurately. This can result in lower premiums for individuals with good health.

- Discounted Rates:

- Many insurance providers offer discounted rates for those who are willing to undergo a medical examination. This is because a thorough examination provides a clearer picture of your overall health and reduces the insurer's perceived risk.

- Long-Term Savings:

- While the initial convenience of a no-medical-exam policy may be appealing, those who opt for a medical exam and secure lower premiums can enjoy significant long-term savings over the life of the policy.

Claim Your Free Life Insurance Quote Now

Mesa, AZ Popular Services: